Navigating Short Term Care

Everything You Need To Know For The Future

What Is Short Term Care Insurance?

Short Term Care Insurance is a type of insurance policy designed to cover the costs associated with short-term health care needs. These needs typically arise when an individual is recovering from an illness, injury, or surgery and requires assistance with daily activities for a limited period. Unlike long-term care insurance, which covers prolonged care over several years, short-term care insurance usually provides coverage for up to 360 days.

Key Features of Short Term Care Insurance

Coverage Duration: Short-term care insurance policies typically offer coverage for periods ranging from a few months to one year.

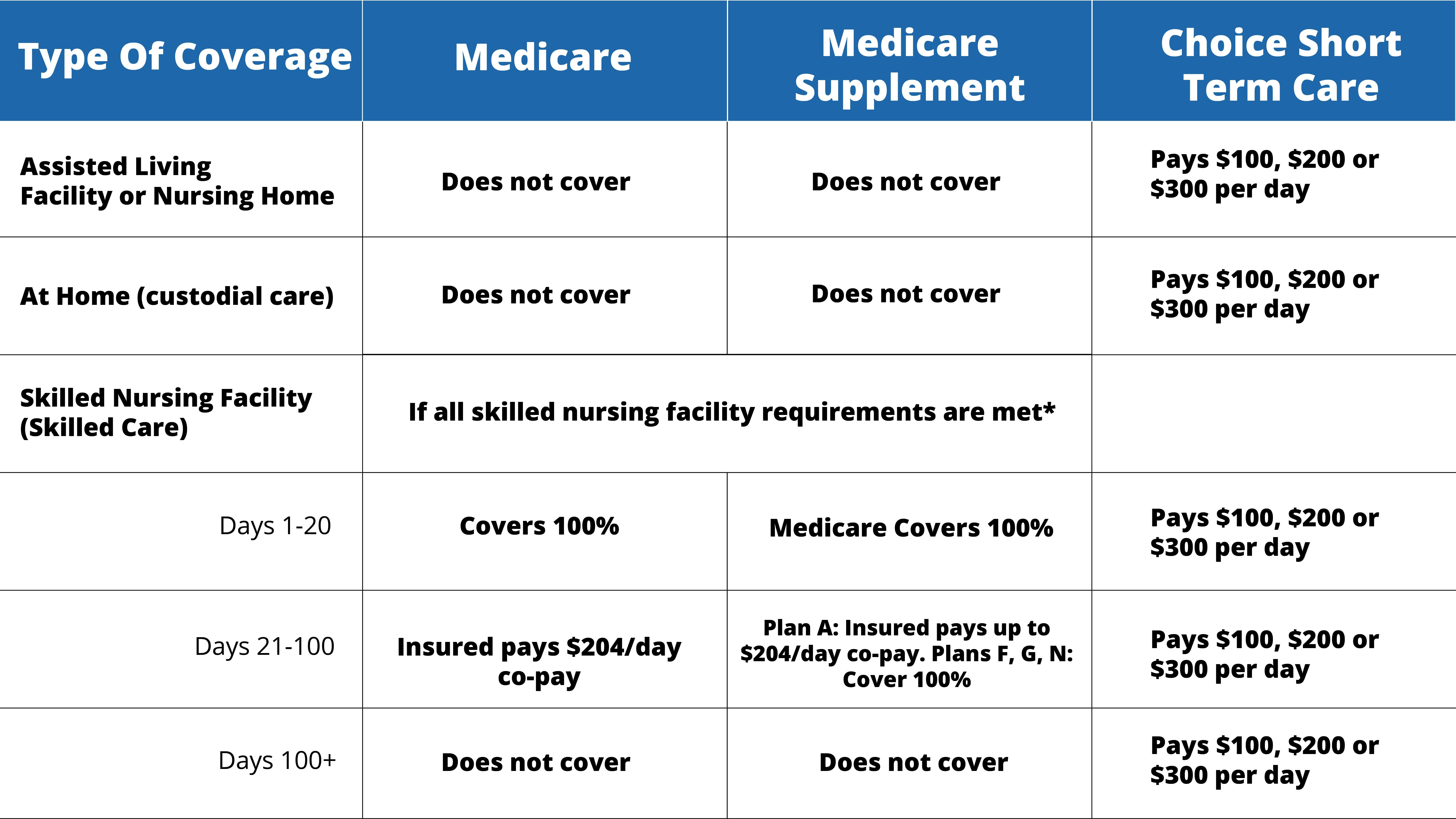

Daily Benefits: Policies pay a set daily amount for care, which can be used to cover expenses such as in-home care, assisted living, or nursing home care.

Qualifying for Benefits: To qualify for benefits, an individual usually needs to be unable to perform two out of six daily activities of living (ADLs), which include bathing, dressing, eating, toileting, transferring, and continence.

Flexibility: These policies can often be tailored to fit individual needs, with options to choose the daily benefit amount and the length of the coverage period.

Simpler Underwriting: Obtaining short-term care insurance often involves a simpler underwriting process compared to long-term care insurance, making it accessible to a broader range of individuals.

Who Can Benefit from Short Term Care Insurance?

Consider the case of Mary, a 68-year-old retiree who lives independently. Mary enjoys good health, but she recently underwent knee replacement surgery. While her recovery is expected to be smooth, her doctor has recommended several months of physical therapy and assistance with daily activities such as bathing, dressing, and preparing meals.

Without short-term care insurance, Mary would need to pay out-of-pocket for these services, which could quickly become expensive and strain her finances. However, with a short-term care insurance policy, Mary can receive the help she needs during her recovery without worrying about the costs. The policy covers the cost of a home health aide who assists her with daily activities and ensures she follows her physical therapy regimen. This not only helps Mary recover more quickly but also provides her with peace of mind, knowing she won’t face a financial burden during her recovery.